Child maintenance is a vital aspect of ensuring that children receive the financial support they need to thrive and grow. If you’re a parent living in the United Kingdom and you’re wondering, “How much child maintenance should I pay?” you’re in the right place. In this article, we’ll explore the key factors and guidelines that will help you understand your responsibilities and make the process as straightforward as possible.

Child Maintenance

Child maintenance is the financial support provided by one parent to the other for the upbringing of their child or children when they live apart. The parent who does not live with the child is typically the one who pays child maintenance to the resident parent. Check our previously published article on Can i calculate the Child Maintenance Fee with the Calculator?

Factors Determining Child Maintenance

The amount of child maintenance you should pay depends on several factors, including:

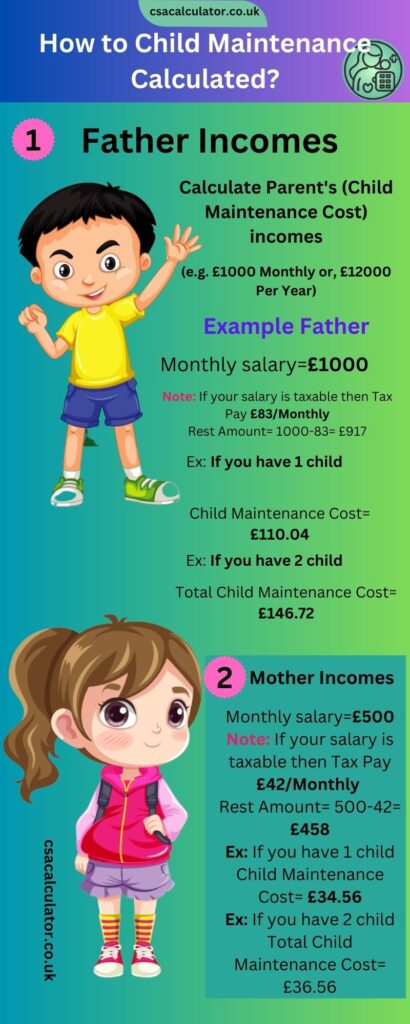

- Your Income: The more you earn, the more you may be required to contribute.

- Number of Children: The more children you have, the higher your overall maintenance payment.

- Time Spent with the Child: If you have shared custody, your financial responsibilities might be different.

- Child’s Age: Older children often require higher maintenance as their needs evolve.

- Special Circumstances: Some children may have special needs, which can impact maintenance calculations.

Arranging child maintenance yourselves

If you and the other parent are arranging child maintenance between you, you have the freedom to determine the amount that one parent pays to the other. This arrangement is known as a family-based agreement.

While there’s no requirement for the Child Maintenance Service to be involved in this process, it’s advisable to compare the amount you agree upon with what they would assess it to be.

Consider what you want to include in your child support payment and how you prefer to make it:

- Would you like to make a consistent fixed payment, or do you want the flexibility to adjust it for extra expenses during the year?

- Do you intend to cover expenses like school uniforms, activities, or holiday costs within the child support amount?

- Are you thinking of basing your payment on a percentage of your earnings? This approach can be beneficial if your income fluctuates, but it may result in less predictable child support amounts.

Note: If you want to know the child maintenance account login process then read my previous article carefully, and from there you can get the information.

How much are you expected to pay?

To get an idea of how much child maintenance you should pay or receive, use the child maintenance calculator on the GOV.UK website.

If you and the other parent can’t come to an agreement on the amount of child maintenance to be paid, you can request the Child Maintenance Service to calculate it for you. Here’s what they’ll consider:

- The number of children you have.

- The income of the parent who is responsible for making the payments.

- The amount of time your children spend with the parent who is making the payments.

- Whether the paying parent is providing child maintenance for other children as well.

How shared care affects child maintenance

Many parents choose to share the care of their children, which can affect the child maintenance payments. The reduction in child maintenance is determined by specific ‘bands’ based on the number of nights your child spends with the paying parent. Here’s how it works:

- If your child spends between 52 and 103 nights with the paying parent, child maintenance is reduced by 1/7th for each child.

- For 104 to 155 nights, child maintenance is reduced by 2/7th for each child.

- If your child stays over 156 to 174 nights with the paying parent, child maintenance is reduced by 3/7th for each child.

- When your child spends 175 nights or more with the paying parent, child maintenance is reduced by 50%, with an additional £7 per week reduction for each child.

Paying for children from another relationship

When the paying parent’s gross weekly income falls between £200 and £3,000, and they are also responsible for child maintenance for other children, this is factored into the calculation. The Child Maintenance Service adjusts the weekly income considered for child support based on the number of other children being supported. Here’s how it works:

- If the paying parent is providing support for one other child, their weekly income for child maintenance is reduced by 11%.

- If they are supporting two other children, their weekly income for child maintenance is reduced by 14%.

- For those supporting three or more other children, their weekly income for child maintenance is reduced by 16%.

- Read our previously published article If I Pay Child Maintenance Should I Pay for Anything Else?

How your income affects how much you pay

Child maintenance rates vary based on the paying parent’s gross weekly income, which represents their earnings before deductions like taxes and National Insurance are applied.

Child maintenance amounts based on weekly pay

| Unknown | Default | £38 for one child, £51 for two children, £61 for three or more children |

| Below £7 | Nil | You don’t pay any child maintenance |

| Between £7 and £100 or if you’re on benefits | Flat | £7 a week |

| Between £100.01 and £199.99 | Reduced | Use the CSA calculator |

| Between £200 and £3,000 | Basic | Use the child maintenance calculator |

If your gross weekly income exceeds £3,000, you have the option to seek a child maintenance ‘top-up’ order through the court. However, the court will require a Child Maintenance Service calculation as a prerequisite before handling your application.

UK child maintenance formulas

The CMS categorizes a parent into one of four groups primarily based on their gross weekly income and government benefits. This category referred to as the rate, determines the formula used by the CMS to establish the parent’s maintenance responsibility.

Gross income includes a parent’s wages, pensions, or other taxable earnings. The CMS initially does not consider income exceeding £3,000 per week, savings, income from a rental property, and their partner’s earnings. However, you do have the option to request the CMS to take these factors into account.

For parents paying the basic or reduced rate, there’s an opportunity to reduce their obligation if they have at least 52 overnights a year due to their residence and contact schedule. It’s important to note that the obligation cannot fall below £7 per week.

| Number of nights of shared care each year | Reduction to child maintenance (for each the child with shared care) |

| 52 to 103 nights | 1/7th |

| 104 to 155 nights | 2/7ths |

| 156 to 174 nights | 3/7ths |

| 175 nights or more | ½ (50%) plus an extra £7 a week’s reduction for each child in this band |

Frequently Asked Questions

Yes, child maintenance can be privately arranged between both parents, but it’s essential to ensure it meets the child’s needs and is in line with CMS guidelines.

Non-payment of child maintenance can have legal consequences, including fines or imprisonment. It’s vital to fulfill your financial responsibilities.

Yes, they can be adjusted if there are significant changes in your circumstances, such as a change in income or the child’s living arrangements.

You can apply for CMS services online, and they will help you calculate and manage your child’s maintenance.

Child support is paid directly to the primary caregiver. However, if you have a family-based arrangement, you can pay child support directly to your child, but only if both parties agree.

Closing Thoughts

Child maintenance in the UK is a legal obligation designed to ensure that children receive the financial support they need from both parents. While the Child Maintenance Service provides guidelines for calculating payments, it’s essential to consider individual circumstances. Open communication between parents and a focus on the child’s best interests are key.

If you find yourself asking, “How much child maintenance should I pay?” it’s always a good idea to seek legal advice or consult with the CMS for guidance tailored to your situation. Ultimately, the goal is to secure your child’s future and provide them with the support they need to thrive.